Just 13 years ago, a whitepaper was circulated on a cryptography mailing list. It proposed a radical alternative to the established concept of currency at a time when the world was still clawing its way out of one of the worst recessions in history, brought about by the failings of the global financial system.

The technology described in that whitepaper was revolutionary as it was the first trustless, peer-to-peer electronic payment system that was fundamentally designed to be transparent and censorship-resistant. The way this was all possible is through a distributed ledger technology called blockchain. The blockchain allows for the native transfer of value from one point to another through a digital asset called Bitcoin.

The potential that it represented quickly began to draw the attention of talented software developers and cryptographers. In 2010, one such programmer, Laszlo Hanyecz, convinced a Papa John’s Pizza outlet to allow him to pay for two pizzas in Bitcoin. He paid 10 000 bitcoin for his dinner that night. Today, 10 000 bitcoin are worth roughly $580 million

It can no longer be argued that the Blockchain is among the most significant pieces of technology ever created. It made it possible to transfer value or store wealth via the use of Bitcoin, which was nothing short of revolutionary. Not only has Bitcoin grown into an asset with a market cap exceeding $1 trillion, it also introduced the world to the concept of a transactional system that is inherently secure, without the need for any individual or institution to act as a governing body. In doing so, it has inspired countless great minds to question how else decentralised systems can change the world. This has given birth to the crypto market as we know it today. A $2.5 trillion dollar market made up of hundreds of blockchain technologies, all of which owe their existence, whether directly or indirectly, to the original cryptocurrency, Bitcoin.

The blockchain technologies vying for Bitcoin’s throne

While many still consider the terms crypto, blockchain and Bitcoin to be interchangeable, the reality is that while Bitcoin remains the largest cryptocurrency by market cap, there are now countless blockchain technologies attempting to solve a huge range of problems, ranging from bankless transactions to monetising art and gaming. Where the Bitcoin blockchain’s native token, or currency, is called Bitcoin, each of these blockchains or cryptocurrency projects issues its own token, which the crypto community has come to call altcoins.

Because Bitcoin, the original cryptocurrency, continues to hold the top spot in terms of market cap, essentially every other crypto is generally referred to as an alternative to Bitcoin. Hence the term ‘altcoin’.

As an example of how diverse the altcoin space has become, the diagram above shows the ecosystem that has been built on just the biggest altcoin technology, Ethereum. Ecosystems of similar scale and complexity are being built on several other blockchain platforms, such as Solana, Polkadot and BNB, to name just a few.

Despite how far it has come, Bitcoin is still in its infancy by any measure and still represents an excellent investment opportunity. The great news for investors, though, is that several altcoins now present a similar investment opportunity that Bitcoin investors had ten years ago. With many altcoin technologies still working out the kinks and discovering their own capabilities, investors have the chance to become early investors in technologies with the real potential to fundamentally change the world.

How big could the altcoin market get?

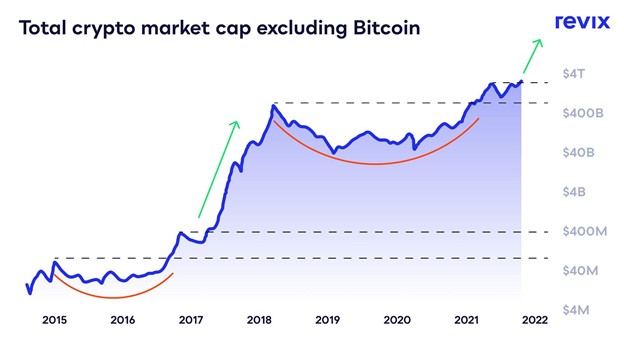

Are altcoins just a fad, and is Bitcoin still the only truly promising investment in the crypto space? A look at the total altcoin market cap over time suggests the answer to that question is a resounding no.

How do I know when it's alt season?

Fortunately, there are a host of metrics and indicators that investors can use to gauge whether or not an alt season seems to be gaining traction. Unfortunately, this is a double-edged sword. With the deluge of often conflicting and subjective messages that the crypto media aims at investors, it’s vitally important to focus on objective data in an appropriate time scale.

Fortunately, that’s exactly what we’re going to provide you with in part two of this series of articles!

Meanwhile, why not wear your Bitcoin on your sleeve?

Whether you’re brand new to crypto investing or someone who has paid for a pizza with Bitcoin, the original cryptocurrency’s legendary status won’t be lost on you. So you’ll be excited to discover that Revix, a Cape Town-based crypto investment platform, is running a competition to win a prize that will make it easy to show the world that you’ve taken the crypto revolution seriously.

Predict what you think the Bitcoin price will be on the 3rd of January 2022 at 12:00 PM, and make an investment of R500 or more in Bitcoin via Revix’s platform, and you could win one of three exclusive pairs of Tateossian® Blockchain Cufflinks. Follow the instructions here to enter.

Revix is a Cape Town-based crypto investment platform which makes it safer and simpler to invest in crypto than ever before. Not only can you buy individual cryptoassets, including BTC, ETH, SOL, DOT and BNB. Also, Revix offers Crypto Bundles, which allow you to buy into an instant diversified crypto portfolio. Perfect for investors who are new to crypto.

Revix is backed by JSE listed Sabvest and offers access to all of the individual cryptocurrencies and bundles mentioned in this article.

source https://www.techradar.com/news/revix09a/

0 Comments:

Post a Comment